Threat of financial sanctions needed to accelerate progress on financial sector’s gender pay gap problem

By: Neil Vowles

Last updated: Monday, 21 January 2019

Dr Mostak Ahamed says regulators need more resources if the UK Government is to achieve its' goal of eliminating the gender pay gap within a generation.

Financial services companies need to show greater commitment to adequately remedying their gender pay gap or face sanctions, academics at the University of Sussex and Queen Mary University of London have recommended.

Professor Geraldine Healy, of Queen Mary University of London, and Dr Mostak Ahamed, of the University of Sussex Business School, say that progress on gender pay issues in the UK finance sector has been too slow, fragmented and uneven over the past ten years despite the impact of Britain’s longest recession in modern times and pressure from the Government to close the gap.

While the gender pay gap in the sector has fallen marginally in the past decade, the new research paper advocates for a more substantial change in improving women’s representation at senior levels, tackling unfair pay systems and culture-change at all pay-scale levels to affect more significant improvements.

The academics also recommend that policymakers need to specifically target strategies at the very highest salary bands and have called for further initiatives to overhaul the uneven distribution of bonuses.

Dr Ahamed, Lecturer in finance at the University of Sussex Business School, said: “The gendered culture of financial services has been resistant to change and the multi-pronged forces on the sector has elicited only small progress in challenging unsafe remuneration policies. The UK Government’s aim to eliminate the gender pay gap within a generation is nothing more than a pipe dream unless regulators are given the resources to enact change much more quickly.

“The finance sector, potentially more than any other sector in the UK economy, needs greater incentive to overcome a large gender pay gap which is enforced with significant barriers for women, including long working hours, lack of flexible work and a male-biased culture.”

Legislation requiring employers with 250+ employees to report their gender pay gap publicly by April 2018 revealed the average gender pay gap per hour at UK banks and building societies is 35% and 52% for bonuses.

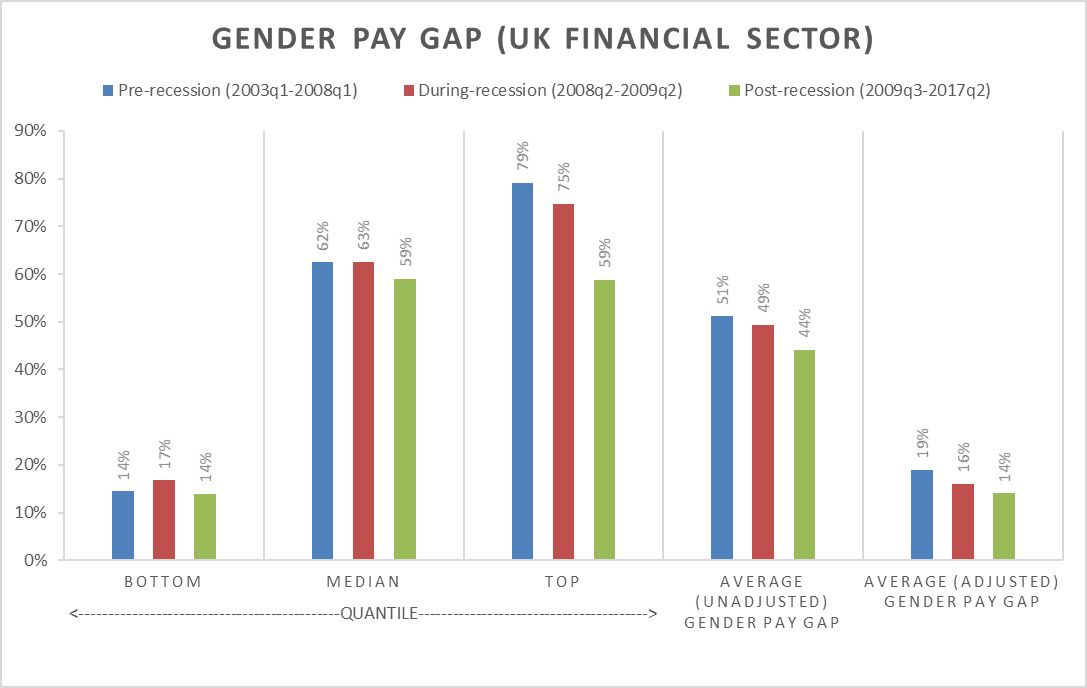

The researchers found that the gender pay gap was substantially larger among the industry’s highest earners – between 2009 and 2017 the pay gap was 13.8% for the 10th quantile of workers’ pay scales but this climbed to 58.6% at the 90th quantile.

Analysis by Prof Healy and Dr Ahamed shows that men working in the finance sector earned 49% more than women during the recession, falling to 44% in the post-recession period between 2009 and 2017.

When controlling for various economic attributes, the study calculated the average conditional pay gap reduced from women earning on average 19% less than men in between 2003 and 2008 to 14% in the period between 2009 and 2017. Put differently, women were still earning almost 14 pence less than every £1 earnt by men ten years into the Government campaign to reform the financial services sector.

Prof Healy, Professor of Employment Relations in the School of Business and Management at Queen Mary University of London said: “Our analysis shows that, when all other factors such as education, experience and childcare responsibility are taken into consideration, women earning the highest wages in the sector are subject to more discrimination and this has decreased only very marginally since before the Credit Crunch. The irony is that the more successful and better paid the woman, the greater the penalty in pay she suffers compared to her male comparator. In addition, lower paid women have experienced year-on-year less pay than lower paid men with little change since the recession.

“The sector continues to be seeped in discriminatory practices with respect to pay and unequal treatment favouring men and disincentivizing women. The increasing intensity of working hours over the ten year period has had a negative effect on the gender pay gap. Financial services has undoubtedly introduced and promoted positive diversity initiatives but these have been undermined at strategic and operational level including by discretionary bonuses and increasingly long working hours. Change is unlikely without external pressures, whether from the unions, women's networks and pressure groups but ultimately by the state introducing more stringent statutory regulations."

Gender pay gap, voluntary interventions and recession: the case of the British financial services sector was published in the British Journal of Industrial Relations this month.